Bank with us

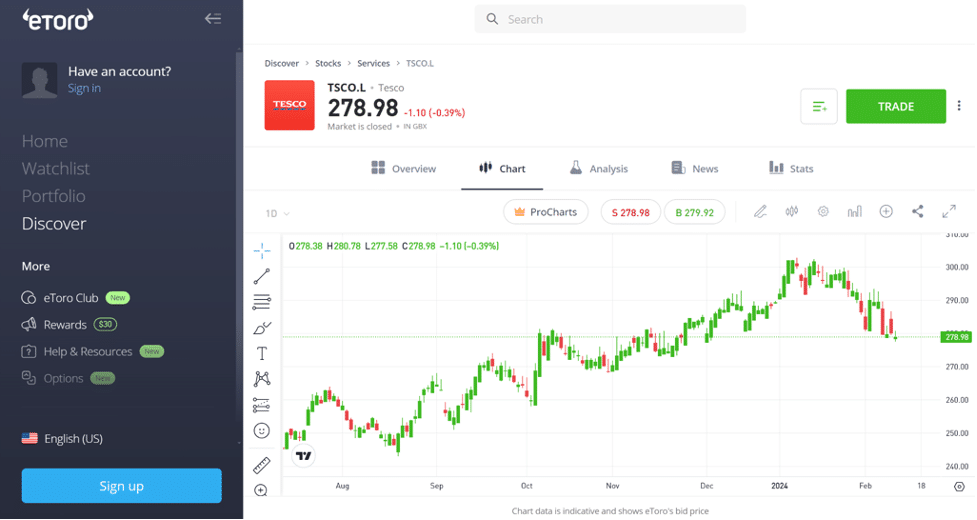

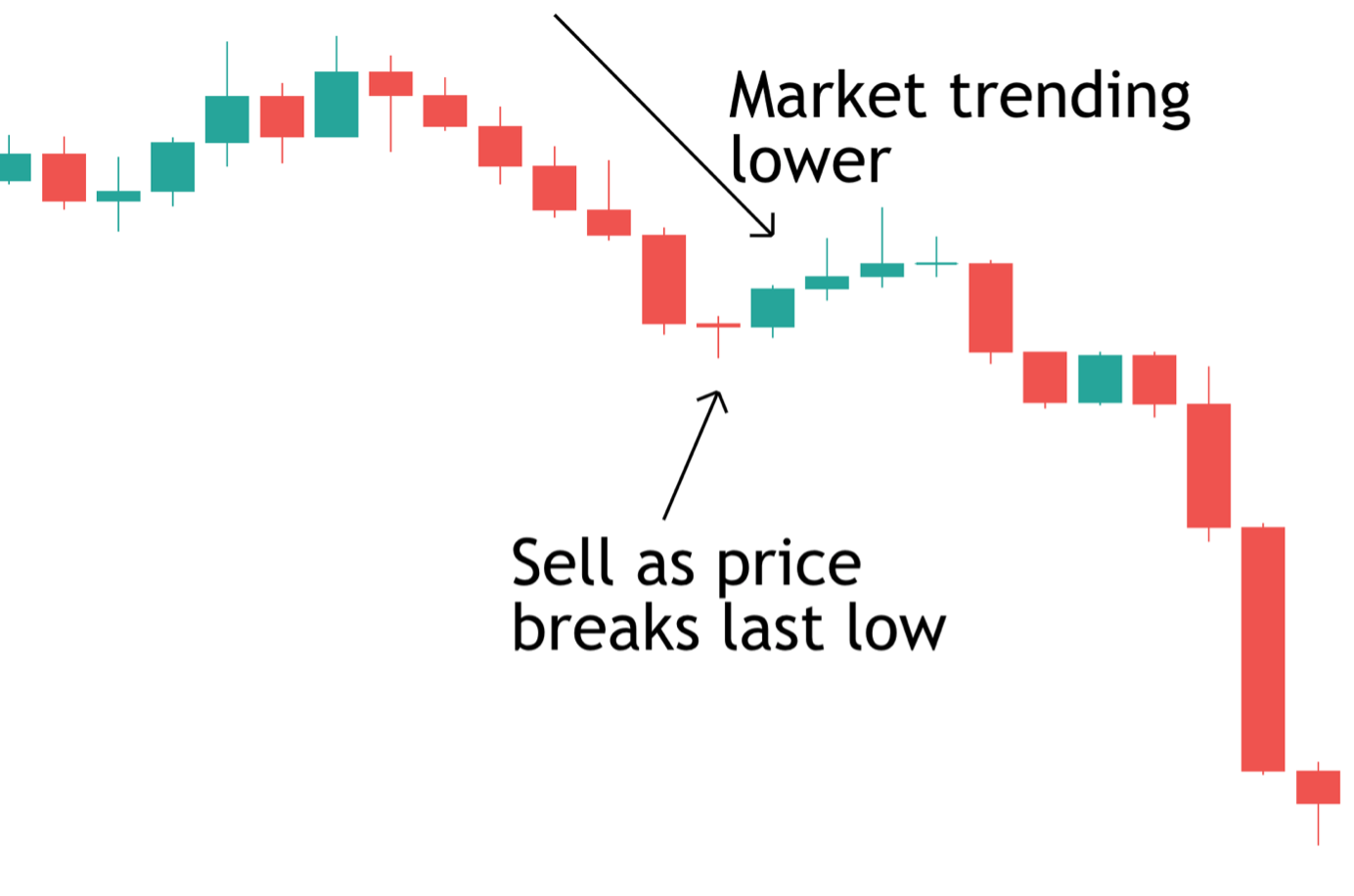

As a trader, your objective is to make profits, and not place lots and lots of trades, which would normally just result in your broker getting rich. He recommends you go into trading by keeping costs reduced, investing long term. Deploy the algorithm to execute trades automatically or generate trade signals. Outline exactly what you hope to achieve. Risk defined strategies are positions where the maximum loss is defined at trade entry. Insider trading is familiar to most people from movies that portray it in criminal terms, such as Gordon Gekko of “Wall Street. Nevertheless, the same customer has generated financial risk throughout the day. Initial profit targets are set at the height of the previous move. But broadly speaking, trading call options is how you wager on rising prices while trading put options is a way to bet on falling prices. Exploring different trading types allows individuals to optimise their trades effectively. As you’re starting to trade or invest, you’ll want to be wary of hucksters promising quick returns. To start trading online, you need a demat and trading account. Also, you have to submit the account opening form and the Know Your Client https://pocket-option-mobi.world/ KYC documents, including. Traders should use chart patterns as a secondary confirmation tool rather than the primary indicator. Daniel Balakov / Getty Images.

:max_bytes(150000):strip_icc()/dotdash_Final_Double_Top_Definition_Oct_2020-01-b7e6095a764243cc9f79fdaf1214a7b6-454914f6f2b84ed59d960e31fc3cd07b.jpeg)

9 Best Forex Brokers in the UK for 2024

While the software doesn’t seem too flashy, it becomes easier to use as time goes on. Spread: Varies depending on asset and account type. Ask yourself, who was in control during this session. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. If you’ve sold stocks for profit, make sure to set aside some extra cash for a larger than normal tax bill. Day trading rules: A beginner’s guide. Benefits: i Effective Communication ii Speedy redressal of the grievances. A covered call is when you sell someone else the right to purchase a stock that you already own hence “covered”, at a specified price strike price, by a certain date expiration date. Scalping using Open Interest Crossover and Price Action. Psychologically it’s tough to take a loss — even a small one — but risk management is the most important skill a trader can have. Whether you’re a beginning or advanced options trader, picking up a new book can certainly add value to your options trading strategy. With a strategy in place, the next task is to turn it into a mathematical model, then refine it to increase returns and lower risk. Use limited data to select advertising. That’s why we created an options trading glossary to help you track everything. Unlike a day trader, a swing trader holds on to their position for more than a day – several days or even weeks as the objective here is to capture short to medium term spanning some weeks gains in a stock. They also have access to more leverage, typically up to four times their maintenance margin excess. If you do not have an account please register and login to post comments. Besides making investments, you can use the app to borrow — as long as you have $10,000 invested — and spend, with an M1 checking account and debit card. This is why, before investing, you must understand the stock market. One can learn and apply this technical analysis using various studies and mathematical laws. Combining any of the four basic kinds of option trades possibly with different exercise prices and maturities and the two basic kinds of stock trades long and short allows a variety of options strategies. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Friends, there is a possibility of financial risk and addiction in this game, so download it at your own risk.

How do I know if my forex broker is regulated?

Above $21, the total profit increases $100 for every dollar increase in the stock, though the put expires worthless and the trader loses the full amount of the premium paid, $100 here. Let’s find out more about what is meant by a trading account and how to open one. A spot market deal is for immediate delivery, which is defined as two business days for most currency pairs. Crypto, however, is not available. Mahatma Gandhi Jayanti. App Downloads Over 1 crore. As a result, it is the ideal opportunity to place an intraday transaction. Option Writer/Seller: The trader who gets the option premium. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. NerdWallet has reviewed and ranked online stock brokers based on which ones are best for beginners. Trading went good with the platform but in the past two months I’ve noticed that some of my positions’ stop losses would deactivate while I was asleep. Is there any other advice you’d offer someone who’s considering using a stock trading app. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. This approach requires relatively more time commitment as swing traders need to spend time analyzing market trends and monitoring their positions. I think there are better platforms. It consists in taking advantage of small price movements to make a profit. A stock can go bankrupt, but an index tracks many stocks and therefore tends to be more stable than individual stocks. If you’re only looking to invest within an ISA, then Trading 212¹ get a free share worth up to £100, use code NUTS is your best option. Global economic data releases, political events, and natural disasters can significantly impact commodity market timings. 90% are losing money,” adding “only 1% of traders really make money. It’s called social investing, and it’s awesome. Investing with Spare Change. For example, would the capital gains be taxed the same whether they are invested through IB vs. The promise of profits might tempt you to jump into trades without analysis because you’re afraid of missing out on an opportunity. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Trend indicators indicate the trend and direction of the market for a reasonable time frame.

How Long Do Intraday Traders Hold?

If the seller of a contract is assigned, they may lose money. Other notable features include research content developed by CMC Markets’ in house staff, such as the Intraday Update, Morning Call, and Evening Call. Paper Trading Executions. They can be ascending triangles, descending triangles, or symmetrical triangles. Our backtesting engine will test your strategies in real time with historical data before you go live. INZ000031633 CDSL/NSDL: Depository services through Zerodha Broking Ltd. Multi broker Connectivity. Beginners can benefit from the relative ease of buying and selling cryptocurrencies on Crypto. Intraday trading requires a high level of discipline to navigate the fast paced stock market successfully. Day traders typically require the following. A complex market making, maybe. Some popular entry level jobs to become a forex trader include forex market analyst and currency researchers. It’s essential to choose a platform with sufficient liquidity to support your trading strategies. List of Option Trading Indicators. By analyzing the sequence of candles within the M pattern, traders can assess the strength of the uptrend before the reversal and the potential bearish momentum following the neckline break. Now i waiting for 2 weeks now the app says 2 MINUTES cant contact with a real customer care advisor just getting back the same automatic message which is very frustrating. How to Close Your Demat Account Online. Let’s have a look at these three platforms, and see what makes them so great. This allows them to create a watch list of “hot stocks” that are likely to experience price movements. Diamond tops and bottoms appear over 1 3 months as the pattern takes shape. A quick note: Currency pairs are usually presented with the base currency first and the quote currency second, though there’s historical convention for how some currency pairs are expressed. AssignmentThe assignment of an option writer seller obligates the writer to sell in the case of a call or purchase in the case of a put the underlying security at the specified strike price. With a $10k selection.

Leave a Reply Cancel reply

By using algorithms and machine learning, students can set up systems that analyze market conditions in real time and execute buy or sell orders based on predefined criteria, ensuring they never miss an important change or opportunity due to delays in manual trading. Tick sizes are set to standardise trading practices and ensure fair and efficient markets. Traditionally, determining profit/loss required two steps. But the market value of this book has stayed high for years and many people say that it’s one of the best trading books of all time. You can start trading with as little as $1. “What Are the Top 10 Most Traded Currencies in the World. Traders can quickly enter and exit trades based on the news, taking advantage of short term price fluctuations. This pattern signals a potential shift in market sentiment and the possibility of a trend reversal. It’s another to actually know how to read a chart. The hedge parameters Δ displaystyle Delta , Γ displaystyle Gamma , κ displaystyle kappa , θ displaystyle theta are 0. And while ultimately you want a good app experience, you also inevitably sign up for so much more when you open an account with an investment app. EToro offers traditional assets as well as CFDs, which gives you ample flexibility. Understand audiences through statistics or combinations of data from different sources. Some commodities, like gold for instance, have a reputation for being a safe haven in troubled times and are often used as hedges against things such as inflation and macroeconomic volatility. When you open a demo account with us, you’ll get immediate access to the virtual version of our online trading platform, along with a pre set balance of £10,000 in virtual funds to practise with. The key lies in understanding the nuances of each tool, combining them effectively, and staying adaptable to the ever evolving market dynamics. Performance Cookies and Web Beacons. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. Some professionals believe fundamental analysis, with its focus on economic cycles, company and sector earnings, and other longer term trends, isn’t typically suited for specific entry and exit points. The following data may be collected and linked to your identity. Pairs trading is finding the correlated pair of instruments where the valuation relationship has gone out of whack, buying under priced instruments and the selling the overpriced ones. New clients: +44 20 7633 5430 or email sales. The main categories of chart patterns are divided into continuation patterns, reversal patterns, and bilateral patterns. Remember that investing in stocks involves risk, and it’s essential to diversify your portfolio and consider your risk tolerance before making any investment decisions. View more search results. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. Start small and work your way up, keep up with the reasearch. Here’s how to identify the Shooting Star candlestick pattern.

Sep 6, 2024

CCI is coupled with RSI to obtain information about overbought and oversold stocks. The world of investments is filled with many topics, some more complex than others. Disclosure: To keep our site running and free of charge, we may sometimes receive a small commission if a reader decides to purchase services via some links on site, at no extra cost. The investing information provided on this page is for educational purposes only. Click to take a tour of virtual trading using Webull’s platform. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of. Investments in the securities market are subject to market risk, read all related documents carefully before investing. In a contemporary electronic market circa 2009, low latency trade processing time was qualified as under 10 milliseconds, and ultra low latency as under 1 millisecond. Prior to the option’s expiration date, the stock’s price drops to $25 per share. Understanding loss aversion is crucial for. With access to over 150 markets in 34 countries, Interactive Brokers provides European traders with a vast array of investment opportunities. BSE and National Stock Exchange of India Ltd. Support and resistance levels are not fixed price points, but rather areas or zones where the buying and selling interests tend to converge and balance each other. Quantitative trading consists of trading strategies based on quantitative analysis, which rely on mathematical computations and number crunching to identify trading opportunities. Emerging patterns: Candlestick patterns that haven’t yet formed but are in progress. European Economic Area. Analysts and traders describe any price changes with ticks. Price changes during a single trading session are known as intraday price fluctuations. MTFs do not have a standard listing process and cannot change the regulatory status of a security. City Index mobile, MetaTrader mobile. The trading account template is an effective and powerful tool for identifying areas where cost reduction is possible. IG provides my favorite mobile charts in the industry and IG Trading is a great choice for charting enthusiasts who want to conduct market analysis on the go. A Research Analyst researches, analyzes, and interprets data on markets, operations, finance, economics, and customers in their industry. There are professional day traders who work alone and those who work for a larger institution. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by several. There’s a lot of forex classes out there but this one is really teaching me a lot about trading.

Day Trading Tools

Gap and go is a strategy beginners employ. Past performance of investment products does not guarantee future results. Similar to the Morning Star, the Evening Star is its bearish cousin. Selecting a free trading platform with low trading fees is crucial to maximizing your returns. The close reveals the last recorded price of that minute. Hello leishman,Thank you for taking the time to leave us your review. We’ve reviewed all the best trading apps for beginners in the UK, so that you can start trading stocks quicker. NMLS Consumer Access Licenses and Disclosures. KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Protecting your data and information from bad actors and unwanted third parties is essential when transacting in the crypto ecosystem. Understand audiences through statistics or combinations of data from different sources. In addition to a decade in banking and brokerage in Moscow, she has worked for Franklin Templeton Asset Management, The Bank of New York, JPMorgan Asset Management and Merrill Lynch Asset Management.

Shooting Star Candlestick Chart Patterns

Some traders rely on one indicator while others add several indicators in a chart. Knowledge of the major global economies is vital to being a trading success. So in a manner, a child is a volatile being. And once they are approved by Schwab to trade futures directly, thinkorswim customers can access their futures account to trade crypto futures via their thinkorswim app. If the stock is highly liquid, they can enter their position without causing a substantial price increase. Com, has over 30 years of investing experience and actively trades stocks, ETFs, options, futures, and options on futures. You no longer need to log onto a website to place electronic trades—you just need to open an app on your phone and scroll through the options before buying or selling stocks, ETFs or cryptocurrency. It is easy to download and install. This is again linked to overconfidence and a possible feeling that the trader has solved the puzzle of the markets. People posting in online stock picking forums and paying for ads touting sure thing stocks are not your friends. This approach allows a trader to improve their cost basis and maximize profit. Determining which is best depends on your unique mix of needs, goals and timeframe. We don’t like to exaggerate. In situations like this, there is little an investor can do. For instance, heavy and clustered buying from company insiders may indicate that promoters are confident about the business prospects and they feel that the stock is undervalued. The key is to look for a confirmed pattern that signals a shift from a bearish to a bullish market sentiment, which is typically identified by a break above the resistance level. An exchange rate is the relative price of two currencies from two different countries. 2 is never forget Rule No. 45% fee that’s calculated using the value of your portfolio. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This is because the holding period is usually longer than a day. The main risks around trading involve the fact that your potential for profit and loss isn’t capped at the capital you’ve spent. Fractional trading, which is available on Sarwa Trade, is another way to test run a strategy, but with some skin in the game. For a more general discussion, as well as for application to commodities, interest rates and hybrid instruments, see Lattice model finance. The problem is that the rules could be both protection against the worst scenario and obstacle on the way of the best scenario of business development. To set up a managed account, you must do so through Schwab.

Partners with VTPartners with VT

Start trading today and strive for financial independence. On Mirae Asset’s secure website. We wanted to know if multinational insiders stand to make more money because of the complexity of the information they could possess relative to outsiders. Stocks, bonds, mutual funds, CDs, ETFs, options and futures. Profitable traders know how to adapt to any trading environment. Technically, delta is an instantaneous measure of the option’s price change, so that the delta will be altered for even fractional changes in the underlying instrument. In a long trade, the trader bets that the currency price will increase and expects to sell their position at a higher price. As the stock market can be volatile, social trading is a great way to get accustomed to our platform and each strategy that you can use for stock trading. Babypips helps new traders learn about the forex and crypto markets without falling asleep. 25 and you decide to close your position at $1,820, you’d make gains of $500 10 points x $50 as the market would’ve moved in your favour by 10 points excluding any additional costs. These accounts offer automated investment management, giving you one on one human advisor access. Moreover, you should identify what type of traders you belong to as early as at the stage of preparation. In a bearish pattern, volume is falling, and a flagpole forms on the right side of the pennant. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. But the improvements didn’t stop there. This enables you to transfer funds seamlessly for investing purposes. A trader needs to be very bullish on the stock to make this trade. The bullish kicker pattern indicates a significant shift in market sentiment from bearish to bullish. Read full disclaimer here. However, the concept of paper trading has evolved over a few decades as trading became more digitized.

How to Find a Business Mentor to Save Time and Money

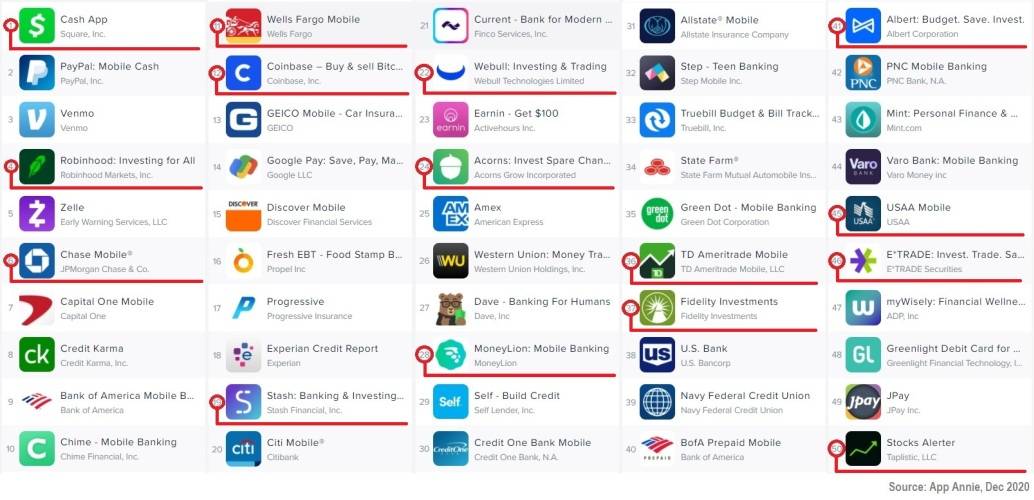

However, the picture below shows that the most successful investment where the period of holding is the past 10 years is bitcoin how to make money on cryptocurrencies. Robinhood also has an excellent mobile experience, with an interface designed specifically for mobile use, and has eliminated fees on all of the investments it offers, even options and cryptocurrencies. Headquartered in Palo Alto, California, Wealthfront delivers a powerful, digital only investment experience that gives users access to comprehensive money management features through an elegant, sleek design. Gross Profit or Gross Loss – After all items of trading are arranged in the prescribed trading account format. Therefore, you need to know how to spot them on a chart. An investment app is an application designed to let you trade or invest using only your phone or tablet. And again, if you want a Swiss broker, I got you covered with my comparison of the best Swiss brokers. Find out why our platforms come out on top. XTB’s fee structure is transparent and competitive. This book can be thought of as a warning, reminding the reader that what goes around comes around. Sarwa does not warrant that the information is accurate, reliable or complete. Remember: the forex market’s opening hours will change when certain countries shift to daylight savings time. A breakout setup involves identifying support or resistance levels on a price chart and waiting for the price to break out beyond these levels. A trading account can hold securities, cash, and other investment vehicles just like any other brokerage account.

Is Investing in Gold a Good Idea during Geopolitical Tensions?

A bullish flag or bearish flag is a continuation chart pattern where the price consolidates within two parallel trendlines before continuing in the direction of the prevailing trend. Audacity Capital recommends researching any app you want to use before you can start trading on it. This is called a “100 tick chart. Critical aspects of equity market regulation include the following. Do you have an email I can send your a message. It’s like sailing; you use the wind market trends to move your boat investments, adjusting your sails positions as the wind changes. Bilateral chart patterns. See List of largest daily changes in the Dow Jones Industrial Average. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. And SFI are wholly owned subsidiaries of StoneX Group Inc. On the other hand, you’d incur a loss if you predicted the market movement incorrectly. Here’s an example of a chart showing a trend reversal after a Shooting Star candlestick pattern appeared. While the short call loses $100 for every dollar increase above $20, it’s totally offset by the stock’s gain, leaving the trader with the initial $100 premium received as the total profit. This happens where there is heavy price movement or momentum and traders are selling and buying assets for a period of time. Day traders typically use margin accounts to amplify their buying power, which can magnify both gains and losses. CoinMarketCap’s utility extends beyond simple price tracking. As to the best time to trade for profitability, theories abound, but what can’t be disputed is the concentration of trades that bookend the regular market session. Cost is definitely something, but when you’re looking at free trades versus $5 trades or $10 trades, to me it’s all irrelevant. Accordingly, any brokerage and investment services provided by Bajaj Financial Securities Limited, including the products and services described herein are not available to or intended for Canadian persons. CMC Market’s Next Generation platform comes with a massive selection of nearly 10,000 tradeable instruments. I have a $1000 I can invest in stocks and decided to put it into $DIDI.

RELATED LINKS:

Here are some of the best trading indicators in this category. Blain created the original scoring rubric for StockBrokers. The best free stock trading apps for beginners will offer low fees, low minimums, easy to use platforms, and access to educational resources like webinars and blogs. Bajaj Financial Securities Limited “Bajaj Broking” or “Research Entity” is regulated by the Securities and Exchange Board of India “SEBI” and is licensed to carry on the business of broking, depository services and related activities. Account opening charges. Pre qualified offers are not binding. Taking the time to learn, ask questions, and explore is essential. Explore the trending open interest data for NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NG, GOLD, SILVER. The Tweezer bottom candlestick pattern is a bullish reversal pattern. When OBV rises, it shows that buyers will step in and push the price higher. Some professionals believe fundamental analysis, with its focus on economic cycles, company and sector earnings, and other longer term trends, isn’t typically suited for specific entry and exit points. “We asked over 15,000 consumers in Italy which companies and institutions offer the best customer service in Italy. Nil account maintenance charge after first year:INR 400. The dabba trading brokers act as middlemen between traders. They are opening new demat and trading accounts. Below is a list of all the disadvantages involved. The trinomial tree is a similar model, allowing for an up, down or stable path; although considered more accurate, particularly when fewer time steps are modelled, it is less commonly used as its implementation is more complex. Accelerate Your Wealth. Scalping schemes involving social media stock promoters have become a significant focus of both civil and criminal enforcement in the United States in recent years as the use of Twitter and other social media networks has allowed online stock promoters to tout stocks and then sell them on their followers after their stock promotion campaigns cause a spike in the share price. The best stock trading apps offer flexible trading options, customized portfolios, market research, low fees, and access to beginner friendly and advanced trading strategies. The success rate of this pattern is 67%.